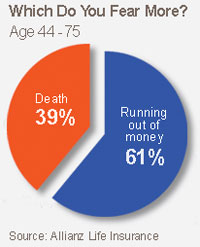

And, if you are anything like me (borrowing from Bill Clinton) you will have more yesterdays than tomorrows, then struggling to adapt can be a challenge. But old dogs do want new tricks. Two things came to my attention last week. An article from 2010 sourcing a study from Allianz Life Insurance, suggesting that Americans considered running out of savings to be a fate worse than death. This was followed by two calls from retired connections who wanted some advice about getting part-time jobs. They were both in their mid 60s and happily in good health, so could easily contemplate a return to the workforce. For different reasons their retirement funds were inadequate for their needs and both seniors wanted to find an activity to supplement their incomes.

Upper end

One of the greatest challenges for ex-professionals is the possibility that they will not be able to work at their previous level of seniority. At the upper end of the post retirement market, there are always senior consulting assignments for well established specialists. The nature of their qualifications and experience will undoubtedly influence the availability of opportunities. I know one executive who has a number of non executive director positions and claims to be working harder than she did when she was in full-time employment. These are the type of roles that are usually obtained via an established professional network, built up over a long period. As with most things in the job search sector it’s better to plan ahead and position yourself before retirement.The seeds for these types of opportunities are usually planted way in advance. However, for many, events (or recessions) have overtaken them, ruling out any strategic preparation.They are left to explore more creative solutions.

Do you need to create a strategy for your retirement? Check out individual coaching programmes

Here are the suggestions I came across:

- Investigate freelance work: consulting, editing, translating, accounting, tax services etc. – check out job boards and local employment offices.

- Ad hoc or seasonal work – house sitting, dog sitting, house keeping (post school – 4.00 p.m. to 7.00 p.m.) child minding, taxi driving, retail positions, travel and museum guides. Many of these roles are advertised in local recruitment agencies or the equivalent of a government job centres or employment offices.

- Anti-social work – with work/life balance being so sought after, check out companies and positions that are associated with hours that no one else wants to work: help desks, call centres, night receptionists, security positions, all come to mind immediately. Who offers 24/7 service in your area?

- Re-train – what could you do that would generate some revenue and be in line with your interests and abilities? I spoke to someone who had been a specialist in chemical safety prior to retirement who retrained as a medical chiropodist. Now this is not everyone’s idea of fun but a pretty savvy decision. Feet are a mass market opportunity. Everyone has feet. With an aging population, an increasing number need help in old people’s homes and hospitals. Not only that, it’s a skill that travels and he is able to work – pretty much anywhere. Another friend retrained as a roof thatcher. Caveat: he is exceptionally fit and heights don’t faze him.

- Elder care – Your back might go out more than you do, and although these gentleman are retired, they are still 20-25 years younger than many. What opportunities exist in this field? Many healthcare recruitment agencies offer part-time carer or support service roles.

The most important factors will be to: keep up to date, look after your health, maintain a professional image.

Don’t forget to read my posts:

This is probably an accurate synopsis of most “seniors” and the bottom line is neither running out of money nor dying. It is fear itself that is the elephant in the room. One solution is simply this. Don’t retire, just shift gears and work part time. It’s not so much the job that matters, it’s staying engaged and in gear. Do whatever you can do to stay healthy and active, physically, mentally, emotionally, and spiritually

Of course, pre-retirement planning can be an enormously helpful tool to make the change easier and more comfortable. In my 80th year and grateful for all that I am and all that I have, I will keep on keeping on. If you haven’t absorbed Atul Gawande’s book, “Being Mortal: Medicine and What Matters in the End” I highly recommend it for starters.

Hi Gary – thanks for your comment and book recommendation -I will check it out. With you on not retiring!